Insurance & Lending:

Verified crop risk intelligence

In today’s evolving agricultural landscape, financial institutions face increasing risks—from volatile weather patterns to fluctuating market conditions. Traditional credit evaluations and insurance models often lack the real-time insights needed to make informed, data-driven decisions.

Transforming Agri-Finance with Analytics

Crop Insurance with Analytics

Multi-peril crop insurance (MPCI) remains heavily regulated and expensive to administer, with claims management and loss adjustment driving significant operational costs. EO analytics enable insurers to streamline verification, develop parametric products, and reduce basis risk.

-

Parametric Insurance Models – Payouts are triggered based on predefined data points (e.g., rainfall thresholds, temperature anomalies), ensuring faster, more accurate claims processing.

-

Crop-Specific Vegetation Indices – Monitor insured fields using calibrated indices tailored to specific crop types and growth stages. Reduce basis risk by correlating index measurements more precisely with actual yield losses, ensuring payouts reflect real-world conditions.

-

Fraud Prevention & Cost Reduction – Satellite verification eliminates the need for extensive on-the-ground assessments, reducing fraud and administrative expenses.

-

Climate-Smart Insurance – analytics help insurers create policies that reward sustainable agricultural practices and climate resilience.

Driving Market Differentiation in Agri-Fintech

With increasing competition in agricultural finance, institutions need innovative tools to stand out. EO-driven insights enable companies to:

-

Offer Advanced Risk Analysis – Provide clients with data-backed insights to improve farm management decisions and creditworthiness.

-

Enhance Customer Engagement – Equip lenders and insurers with tools to monitor loan portfolios, optimize risk assessments, and provide proactive support to clients

-

Scale Operations Cost-Effectively – Remote monitoring allows institutions to expand into new markets without additional field staff.

Real-World Use Cases

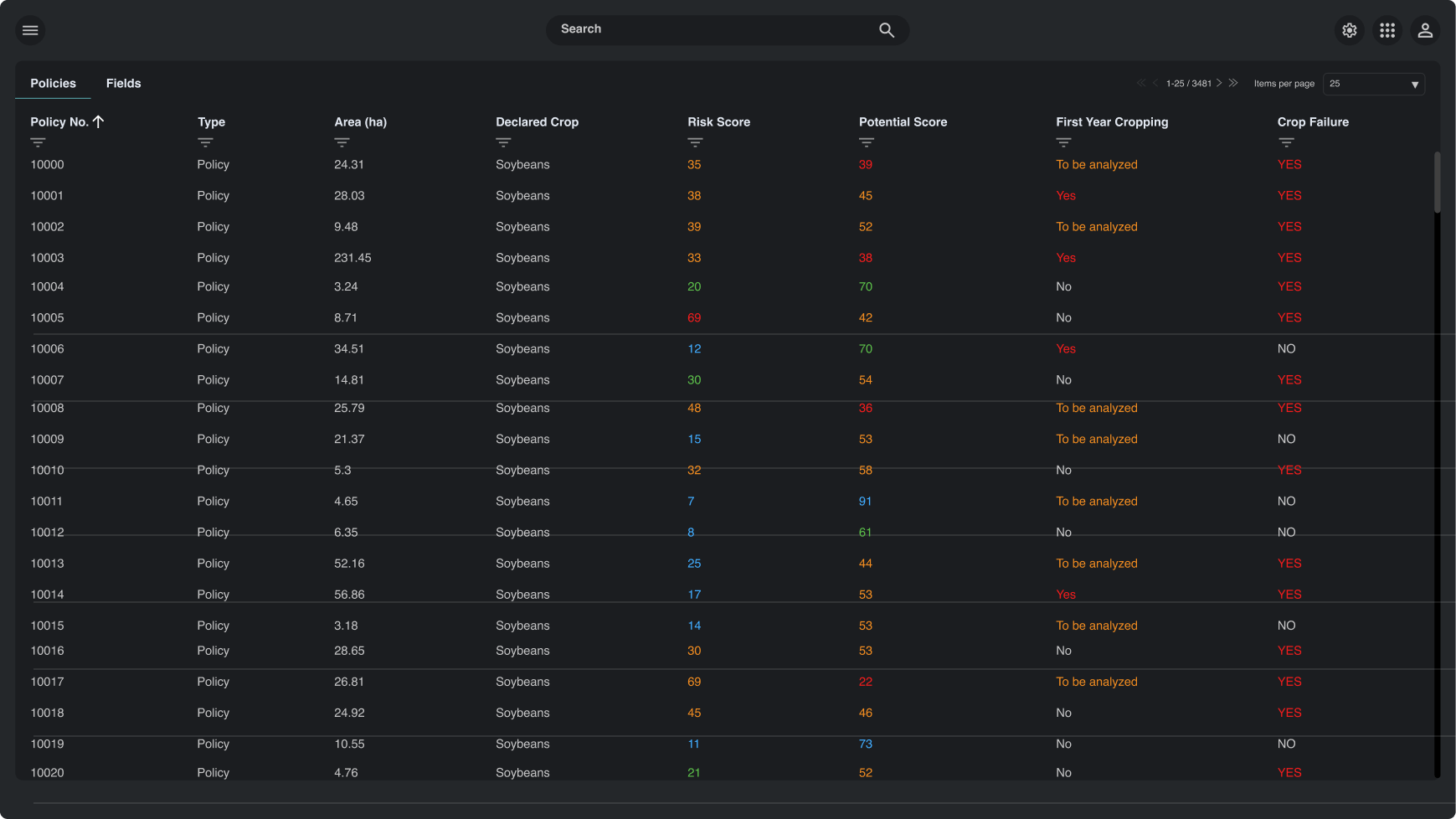

Portfolio Monitoring

Challenge:

Lenders struggle with real-time risk assessment for active agricultural loans, leading to delayed responses to adverse weather events and financial instability.

Solution:

A leading agri-fintech firm utilizes the EarthDaily Agriculture Platform to map all active loans against satellite data, tracking weather impacts, crop stress, and yield potential in real time.

Outcome:

Automated alerts notify lenders of risk factors, enabling proactive credit term adjustments and risk mitigation strategies, improving overall portfolio health and reducing defaults.

Index-Based Products

Challenge:

A global reinsurer wants to expand agricultural coverage into emerging markets, but traditional multi-peril insurance requires loss adjustment infrastructure that doesn't exist in target regions.

Solution:

The reinsurer uses EarthDaily's historical EO archive and crop-specific vegetation indices to develop parametric products with satellite-derived triggers, replacing manual field assessments.

Outcome:

Insurance partners in six countries launch index-based products within one growing season. Historical back-testing demonstrates payout accuracy, accelerating farmer adoption without building field operations in each market.

Market Differentiation

Challenge:

A fintech company specializing in ag lending wants to stand out in a competitive market where traditional lenders take weeks to process operating loan applications.

Solution:

The company integrates EarthDaily's satellite-derived crop data and historical yield analytics into their underwriting workflow, enabling automated verification of planted acreage, crop type, and production capacity without field visits.

Outcome:

Loan proposals delivered in days instead of weeks. Faster turnaround attracts borrowers frustrated with traditional lender timelines, while automated verification reduces underwriting costs and default risk.

This is where satellite-driven analytics revolutionizes agricultural finance. By leveraging high-resolution satellite data and advanced analytics, lenders and insurers gain a competitive edge with improved risk assessment, portfolio monitoring, and innovative financial products.

Advanced EO Analytics for Agri-Fintech

Productivity Risk Score

Understanding field performance variability is crucial for lenders and insurers. The Productivity Risk Score quantifies how consistently a field has performed over multiple seasons. Fields with low scores demonstrate stable yields, while high-scoring fields show fluctuations between strong and weak years. This data helps financial institutions evaluate production risk more accurately, leading to better-informed decisions in lending and insurance underwriting.

Planting Validation

Ensuring that farmers plant crops as intended is vital for financial stakeholders. Planting Validation Analytics leverages satellite data to verify if an entire field has been planted, whether planting occurred within the optimal window, and if the correct crop was sown. These insights provide insurers and lenders with the assurance that loans and policies align with actual field conditions, reducing risk exposure and improving service efficiency.

Crop Identification

Remote sensing technology allows for precise Crop Identification throughout the growing season. By analyzing satellite imagery, financial institutions can verify what crops have been planted, ensuring compliance with loan agreements and insurance policies. This data is also instrumental in benchmarking farm performance against regional conditions, enabling more accurate yield forecasting and financial planning.

Advanced Analytics for Smarter Decision-Making

EarthDaily’s

Agriculture intelligence platform delivers:

Comprehensive Weather Analytics

Vegetation Index Monitoring

Parametric Data Exports

Field-Level Benchmarking

Flexible API Integration

Automated Alerts & Notifications

Take the Next Step