From U.S. Corn Outcomes to Brazil’s 2026 Soybean Outlook: What the Data is Showing Now

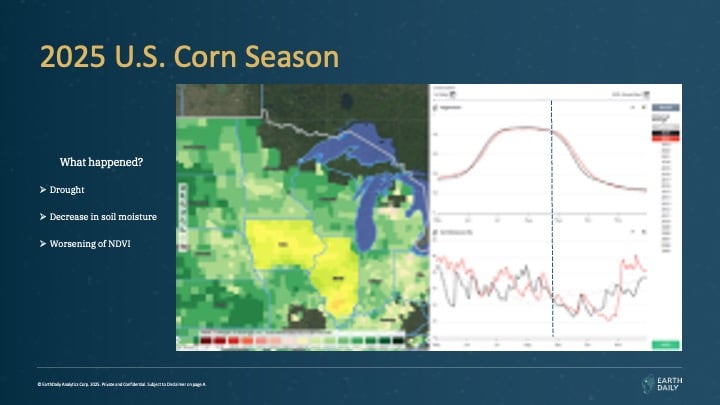

Mid-season signals don’t usually define how a season ends, but they often show where limits begin to form. That’s what happened in the 2025 U.S. corn cycle. Through mid-July, vegetation signals pointed to a very strong outcome. What followed was falling soil moisture and disease pressure. That didn’t undo the progress, but it did cap yield potential.

Looking back at that shift is useful as we now turn to the early stages of Brazil’s 2026 soybean season. These observations were shared during our December 11 webinar with Bloomberg, where Felippe Reis, Crop analyst at EarthDaily, reviewed how the U.S. season played out and what early indicators are showing in Brazil.

What Shaped the 2025 U.S. Corn Outcome

This review returned to the same questions raised in our July mid-season outlook: what changed after mid-season, whether those changes were visible earlier in the data, and how the final outcome compared.

For most of the cycle, conditions were solid. NDVI stayed elevated from early development through mid-August, reflecting healthy crop vigor and strong yield potential. After that point, vegetation declined more quickly than usual and finished the season below both last year’s level and the long-term average.

The main constraint was moisture. Soil moisture dropped during August, limiting how much of the early-season strength could carry through to harvest. Reports of disease pressure in some areas aligned with the weakening vegetation signal. The crop itself had developed well; late-season conditions simply set the ceiling.

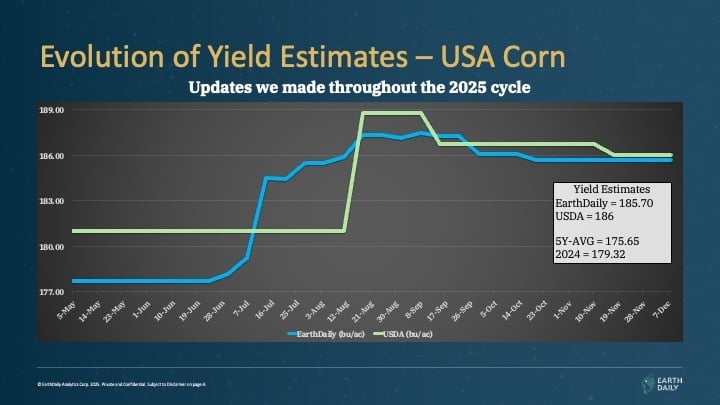

That sequence showed up in the yield estimates. Earlier in the season, the data was pointing toward a very strong outcome -- around 11.8 tonnes per hectare, or roughly 187 bushels per acre. As August progressed, falling soil moisture and reports of disease pressure began to show up more clearly in the indicators, and we revised the estimate in September. USDA followed with a similar adjustment later, in November, once harvest was largely complete.

Even with those late-season limits, the crop still finished in good shape compared with last year and the five-year average, largely because of how strong conditions were earlier in the cycle.

This review picks up from the mid-season assessment we shared in July, where early NDVI and weather signals were already pointing to how the season might unfold.

You can read our analysis here: From Daily Satellite Signals to Market Insight: What We Learned from Our Mid-Season U.S. Crop Outlook

Early-Cycle Outlook: Brazil’s 2026 Soybean Season

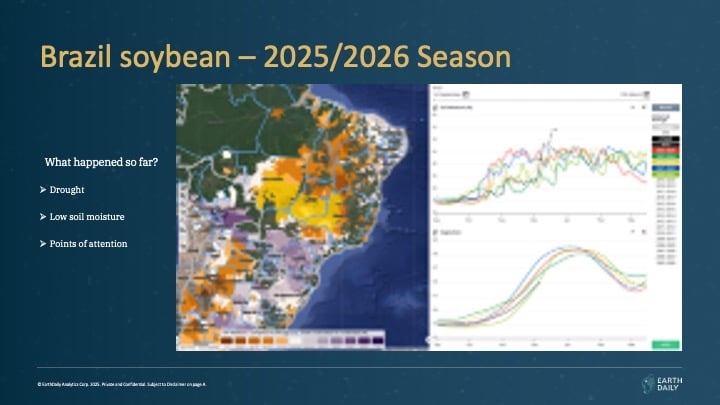

Once the U.S. corn season was done, we turned to Brazil. Planting started early in Mato Grosso, back in September. In Rio Grande do Sul, a lot of the crop was still going into the ground in early December.

That staggered calendar means early-season conditions affect regions differently and at different moments.

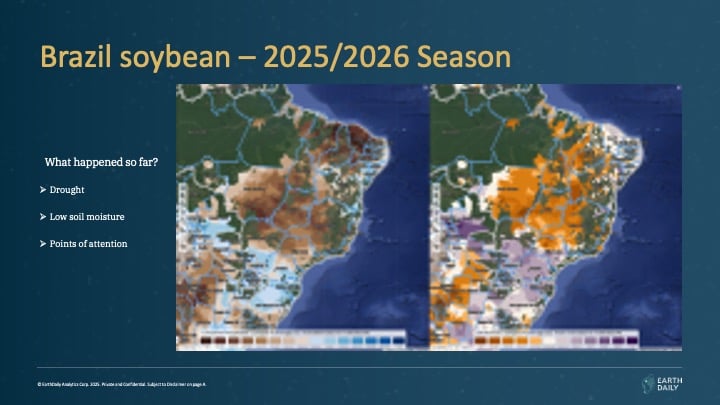

From September through late November, rainfall was below average across much of Brazil. Soil moisture followed the same pattern, leaving roughly half of the soybean area under some level of water stress heading into December.

That has started to change. By December, soil moisture had started to recover across a wide area, from Mato Grosso through Minas Gerais. Rainfall picked up, and conditions became more favorable for crop development.

Where Things Stand Now

After the dry start in key producing regions, the current soybean yield estimate remains more conservative than those from USDA and Conab. At the same time, improving soil moisture leaves room for upward adjustment, depending on how vegetation develops.

NDVI is still relatively low in some areas, reflecting delayed planting and earlier moisture stress.

We have seen this kind of pattern before, including in the 2020/21 season, where early NDVI readings were slow to pick up and then improved as the crop moved along. Some of the lower values may also be tied to cloud cover rather than field conditions, which is why we’re watching the next set of updates closely.

What matters now is the next few weeks. How NDVI develops during this period will tell us whether early stress stays in the system or fades as the crop gains momentum.

From here, it’s a matter of tracking soil moisture, rainfall, and vegetation together and adjusting expectations as those signals settle.

EarthDaily’s Agriculture Monitoring Approach

EarthDaily’s Agriculture solutions deliver near-real-time satellite intelligence to help people and organizations make better decisions throughout the growing season and beyond. We combine daily Earth Observation data with weather and soil information, and we compare current conditions with historical patterns to give a clear picture of how crops are developing around the world.

That data supports a wide range of users across the agricultural value chain. Commodity traders can track production trends and get early insight into global crop conditions. Digital agriculture teams can monitor fields with high-frequency signals that reveal stress or anomalies faster than traditional reports. Insurers and lenders can use unbiased, continuous data to assess risk and support underwriting or financing decisions.

The system is built to provide continuous, calibrated indicators, including vegetation indices like NDVI, updated every day and presented in ways that make it practical for monitoring crop health, spotting emerging issues early, and comparing current performance against past seasons.

Explore our products and solutions for agriculture, get in touch.